Highlights

- Shenghe Resources (Dechang) named to Liangshan Prefecture's top 50 industrial enterprises list, signaling continued state support for strategic rare earth processors in China's interior provinces.

- The company's recognition highlights China's 'local champions' strategy—elevating key materials firms as regional anchors while advancing deep-processing capabilities to move up the value chain beyond basic oxides.

- China's emphasis on 'green development' in rare earth processing serves dual purpose: meeting ESG requirements for global OEMs while strengthening competitive positioning against Western efforts to build alternative supply chains.

This highlights China’s Rare Earth “Local Champions” strategy.

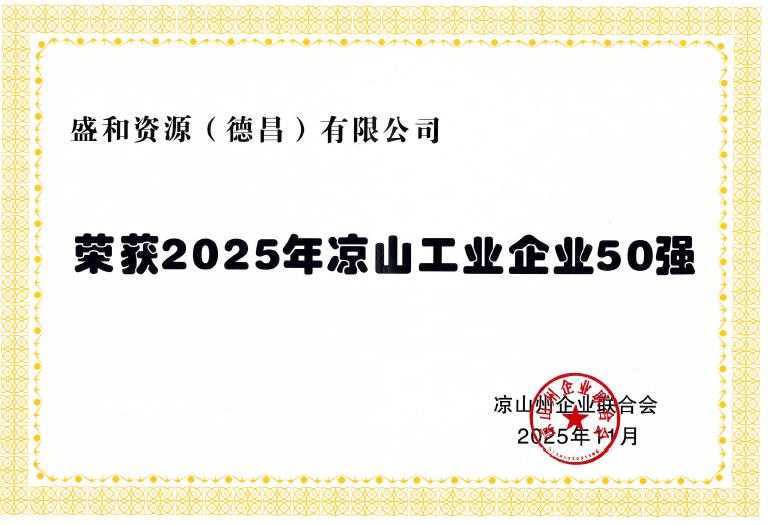

A Shenghe Resources subsidiary in southwest China—Shenghe Resources (Dechang) Co., Ltd.—was included on Liangshan Prefecture’s 2025 list of the top 50 industrial enterprises, according to a recent local release.

While framed as a regional honor roll, the update is notable for global rare earth watchers because it signals continued political and economic support for “backbone” firms embedded in China’s rare earth supply chain—especially in resource-rich interior provinces that feed the national processing and magnet ecosystem.

The announcement credits the company’s standing to “overall strength” and “industry contribution,” but the core business claim is more specific: Shenghe (Dechang) is described as a key rare earth value-chain enterprise in Liangshan whose rare earth deep-processing technology has reached an industry-leading level, helping drive local industrial upgrading. The language is promotional and does not cite independent performance metrics, yet it reinforces a familiar Chinese industrial pattern: local governments elevate strategically important materials companies as regional anchors, then wrap them into broader industrial planning, permitting, financing, and infrastructure coordination.

The release also emphasizes “green development” and process optimization—stating the company has improved both environmental and economic performance through technological upgrades—while highlighting supply-chain collaboration that allegedly pulls surrounding firms into growth.

For Western audiences, “green” framing here should be read as both an ESG signal and a competitiveness tool: if China’s producers can claim cleaner, more efficient operations while scaling, it strengthens their positioning with downstream OEMs facing tighter sustainability requirements.

Relevance ex-China?

Even when no new export controls are announced, these “enterprise recognition” notices can be an early indicator of who Beijing and provincial governments view as strategic long-term winners—and therefore who may receive preferential support. If Shenghe (Dechang) is indeed advancing deep-processing capabilities, it points to continued Chinese investment in moving up the value chain rather than merely shipping concentrate or basic oxides—exactly the step the U.S. and allies are trying to replicate outside China.

Disclaimer: This item is based on reporting from media associated with China’s state-linked industrial ecosystem. Claims, rankings, and performance statements should be independently verified using third-party sources before making investment, procurement, or policy decisions.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments