Highlights

- China Rare Earth Industry Association held its 2025 Annual Meeting.

- Technical seminars focused on optical and photonic functional materials reliant on rare earth elements like europium, terbium, and yttrium.

- The conference emphasized:

- Supply-chain coordination

- Technological innovation pathways

- China's strategic shift from raw material dominance to value-added manufacturing leadership in high-tech applications

- Event timing follows China's rare earth price index launch.

- Signaled coordinated integration of pricing power with application-level industrial planning to create strategic economic and geopolitical leverage.

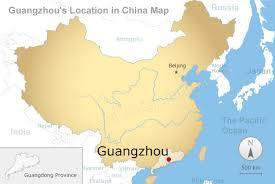

Last month the China Rare Earth Industry Association has issued a formal notice announcing the 2025 Annual Meeting of the Optical Functional Materials Branch, combined with a Technical and Industrial Development Seminar, happening last month for two days (December 26–28, 2025), in Guangzhou, China.

According to the Association’s December notice, the meeting sought to align industry, research institutions, and downstream manufacturers around the next phase of optical and photonic functional materials development, a segment increasingly reliant on rare earth elements such as europium, terbium, yttrium, cerium, and neodymium. This integration of upstream, midstream, and downstream deep into vertical industry research and development remains a major threat to U.S. ascendancy in the critical mineral and, particularly, the rare earth element industry.

Rare Earth Exchanges™ frequently covers how these elements are used in advanced R&D for downstream sector innovation, such as in life sciences, green energy, electrification, electronics, or defense.

These materials underpin phosphors, lasers, LEDs, optical coatings, sensors, and emerging display and defense-related technologies.

The agenda last month placed strong emphasis on:

- Technological innovation and industrialization pathways for rare–earth–enabled optical materials

- Supply-chain coordination between upstream rare earth producers and downstream functional material manufacturers

- Standardization, quality control, and application expansion, reflecting China’s broader effort to move beyond raw material dominance toward value-added manufacturing leadership

Participation includes representatives from rare earth mining and separation groups, materials companies, universities, and national research institutes, reinforcing the Association’s role as a coordinating body between policy, science, and industry.

From a Rare Earth Exchanges perspective, the timing of the event was notable. The conference followed closely on the launch of China’s rare earth price index, as we scooped, and the ongoing consolidation of pricing, production quotas, and downstream strategy. Together, these developments signal a coordinated push to integrate pricing power with application-level industrial planning, particularly in high-value sectors like optical and photonic materials.

For Western policymakers and manufacturers, the event underscores a recurring theme: China is not only managing rare earth supply, but actively orchestrating downstream technology ecosystems where rare earth inputs translate into strategic economic and geopolitical leverage. The Western media and much of the policy-making apparatus in Washington, D.C., have not figured this out yet.

Disclaimer: This brief is based on a notice published by a Chinese state-linked industry association. Details should be independently verified before forming commercial, policy, or investment conclusions.

©!-- /wp:paragraph -->

0 Comments