Highlights

- Minas Gerais is positioning itself as a rare earth processing hub with credible geology (20-23% global reserves) and $655M in capex from Viridis Mining and Meteoric Resources projects.

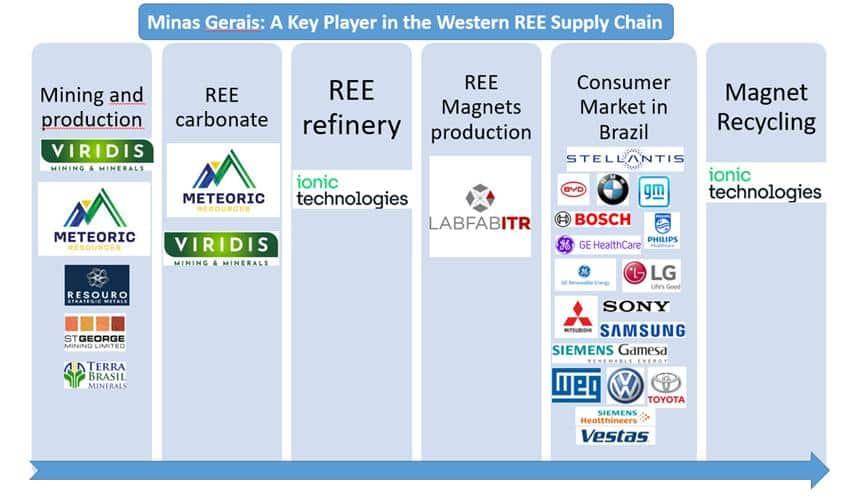

- The state's strategy links extraction to downstream processing and industrial policy, potentially making Brazil a non-Chinese supply pillar for U.S. and EU diversification goals.

- Despite optimistic rhetoric and political will, projects remain early-stage with mid-December licensing decisions ahead and multi-billion-dollar processing infrastructure still unproven.

A new BNamericas report (opens in a new tab) (Dec. 12, 2025) captures a real shift: Minas Gerais, Brazil’s mining heartland, wants to become a rare earths hub. This is not a sudden awakening. Rare Earth Exchanges (REEx) documented the state’s pitch months ago—flagging Poços de Caldas as the anchor and warning that ambition would collide with execution (see “Minas Gerais Pitches Itself as Brazil’s Rare Earth Hub,” Sept. 24, 2025). The latest comments from Vice Governor Mateus Simões add policy color, not proof of arrival.

Table of Contents

What the Facts Support

The geology is credible. Brazil holds roughly 20–23% of global rare earth reserves, with meaningful concentrations in Minas Gerais—especially Poços de Caldas. The presence of Viridis Mining (Colossus) and Meteoric Resources (Caldeira), with combined capex estimates around US$655 million, is real and material for an early-stage district. The state’s intent to pair extraction with downstream processing also aligns with hard lessons from global supply chains: mining alone does not confer leverage.

Simões’ analogy to niobium—where Minas Gerais dominates globally—explains the policy instinct. The involvement of Codemig/Codemge signals a willingness to deploy public assets to de-risk private capital, a model familiar to investors watching China’s playbook.

Where Optimism Runs Ahead

The BNamericas framing leans optimistic, and the rhetoric suggests momentum that timelines do not yet justify. These projects remain exploration to early development. Licensing decisions—scheduled for mid-December—are gates, not finish lines. Talk of processing chains and metallurgy is plausible, but integrated separation and refining routinely require multi-billion-dollar investments, long permitting cycles, and technology transfer. None of that is secured.

The implication that Minas could quickly challenge Chinese dominance drifts into boosterism. Investors have heard “next REE hub” before—Africa, Greenland, elsewhere—with uneven outcomes.

Why This Still Matters

What’s notable is sequencing. Minas Gerais is publicly linking rare earth strategy to processing, logistics, and industrial policy, not just ore. If even part of this plan materializes, Brazil could become a credible non-Chinese pillar—aligned with U.S. and EU diversification goals. That is a long game.

The REEx Take

BNamericas is right on reserves, projects, and intent. The bias lies in inevitability. Capital availability, permitting discipline, and processing know-how will decide the outcome. Minas Gerais has scale and political will; proof will require time.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments