Highlights

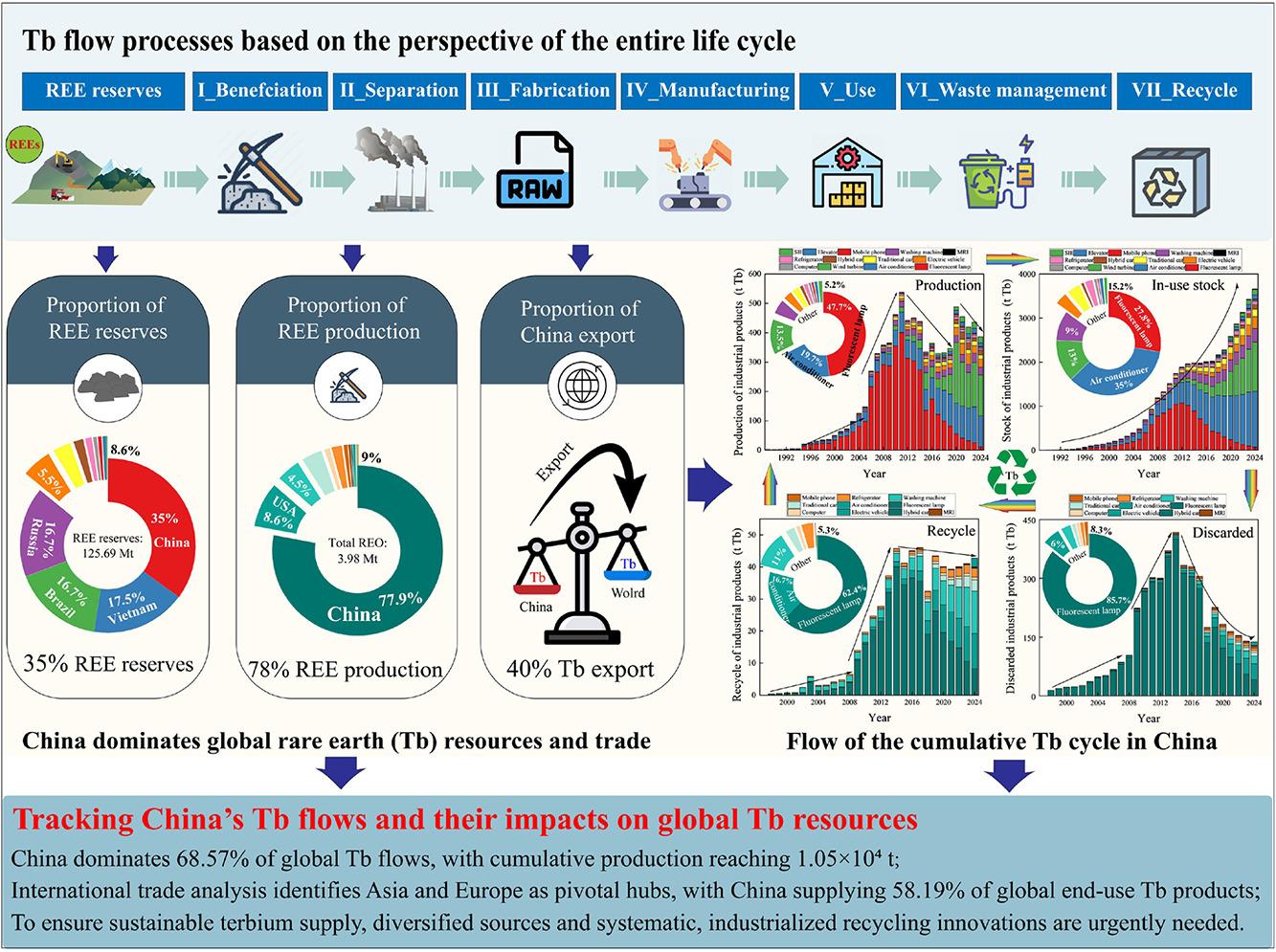

- China dominates 68.57% of global terbium flows through integrated control of mining, separation, and magnet production—not just geology but industrial infrastructure.

- Terbium demand shifted dramatically from lighting phosphors (74.5% in 2007) to permanent magnets (90% post-2021), driven by EV and clean-tech electrification.

- Recycling potential exists in 381.8 tonnes from fluorescent lamps and appliances, but lacks industrial-scale collection and processing infrastructure to address future supply constraints.

Wei Liu (opens in a new tab) as well as corresponding author Xianchuan Xie (opens in a new tab), both at Nanchang University along with colleagues across Chinese institutions and international collaborator Evgeny Abakumov (opens in a new tab) from Saint Petersburg State University, Saint Petersburg, Russia deliver one of the most detailed “follow-the-metal” reconstructions yet of terbium (Tb)—that scarce heavy rare earth critical to high-performance magnets used in EVs, wind turbines, robotics, and defense systems.

Using a spatially and temporally explicit material flow analysis (MFA) spanning 1990–2024, the team maps how terbium is mined, refined, manufactured, traded, used, discarded, and potentially recycled—finding that China accounts for 68.57% of global Tb flows and that clean-tech electrification is steadily shifting Tb demand from lighting phosphors toward permanent magnets.

Table of Contents

Why Terbium Matters

Terbium is “rare” not because it’s mythical—but because it is geologically scarce and difficult to isolate. Yet it is extremely valuable in small doses: adding Tb to NdFeB permanent magnets helps them retain magnetic strength at higher operating temperatures—exactly what many high-performance electric motors, industrial robotics, and certain defense applications require. In other words, Tb isn’t just another input; in some performance tiers, it is a design enabler.

Study Methods

How the team tracked a metal through an entire economy

The authors built a full life-cycle MFA model tracking terbium across seven stages:

- Mining & beneficiation

- Refining & separation

- Primary product processing (e.g., phosphors, magnet materials)

- End-product manufacturing

- In-use stock (Tb sitting inside products in service)

- End-of-life management

- Waste treatment & recycling

They draw on government yearbooks and industrial bulletins for production/activity data, and use international trade datasets (including ITC Trade Map and UN Comtrade) to estimate trade flows—translating everything into Tb-equivalent content (how much Tb is actually embedded in products moving through the system).

Takeaways

As Rare Earth Exchanges™ has chronicled, China controls the system—not just the mines. What follows are key findings.

1. China-centered dominance is measurable—and enormous

The model estimates that China accounts for 68.57% of global Tb flows, with cumulative Tb flow/production on the order of ~1.05 × 10⁴ tonnes in the authors’ accounting. This is not merely “market share.” It reflects system-level leverage—the capacity to convert feedstock into separated materials and high-value Tb-bearing products, and to influence how much leaves China and in what form.

2. Ion-adsorption clays are a strategic lever

China’s ion-adsorption clay deposits supply 53.8% of China’s Tb output, translating to roughly 39.5% of global Tb production in the authors’ estimate. These deposits—mainly in southern China—are disproportionately important for heavy rare earths and help explain why Tb remains a hard-to-replace chokepoint metal in the modern industrial chain.

3. The end-use story has flipped: from lamps to magnets

Terbium once flowed primarily into phosphors for fluorescent lighting (peaking at 74.5% of market flow in 2007). The paper shows that this era has been overtaken by the magnet economy: since 2014, the center of gravity shifted toward magnets, and post-2021, ~90% of Tb flows are tied to permanent magnets. That transition tracks the real economy—electrification, automation, and high-efficiency motors scaling faster than legacy lighting.

4. Recycling potential exists—but the system isn’t ready

The authors identify the most significant near-term “urban mine” for terbium in:

- Fluorescent lamps (estimated recovery potential ~381.8 t)

- Home appliances, a growing and steady stream of Tb-bearing end-of-life products

They argue that without industrial-scale recycling, constraints will intensify—especially as future end-of-life waves arrive from longer-lived assets like wind turbines and new energy vehicles, which can create delayed but substantial recovery needs.

The REExLens Plus Implications for China’s processing dominance

This authors here reinforce a central REEx point: China’s advantage is not only geology—it is industrial integration. Even if new mines come online elsewhere, terbium’s strategic vulnerability often sits in separation, metallurgy, and magnet-material conversion. The paper’s trade mapping suggests that global Tb flows remain heavily concentrated around China-centric routes, including bidirectional dynamics where China imports certain inputs while exporting higher-value Tb-bearing forms.

Implication 1: Ex-China supply is not “just build a mine.”

Tb is a chokepoint metal. A mine without downstream separation, metallurgy, and qualified magnet production does not resolve strategic dependency.

Implication 2: Recycling is strategically real—but operationally immature.

The study frames recycling as essential, but underscores that scaling requires policy alignment, industrial capacity, and reliable collection streams—not just lab validation.

Implication 3: Environmental and governance risk is part of the supply chain.

The paper highlights environmental leakage from mining/smelting and discusses persistent informal/illegal mining dynamics in heavy rare earth feedstocks—reminding readers that “clean tech” demand can be linked to supply routes carrying ecological and governance liabilities.

Limitations: what this study cannot prove

This is a rigorous systems analysis—but it remains a model. Key limitations include:

- dependence on yearbooks, bulletins, and trade codes that may miss misclassification or illicit flows;

- reliance on literature averages for Tb content coefficients;

- partially unquantified “hidden” Tb in low-content products and waste streams; and

- no guarantee of future demand/price outcomes—this is a historical-to-current mapping framework, not a market forecast.

A Metal Map Clarifying the Real Battleground

This paper is not merely about terbium—it is a case study in how industrial control becomes geopolitical control. As electrification and automation expand, Tb demand is increasingly pulled toward permanent magnets, where performance requirements tighten supply tolerance. The authors show that China’s dominance is structurally rooted in heavy rare earth feedstocks and, crucially, downstream conversion capacity. For investors and policymakers, the message is clear: diversification requires processing, recycling, and industrial scale—not slogans.

Citation: Liu W., Guo W., Chen J., et al. Tracking terbium metabolism in China with implications for its dominance in global rare earth supply. Resources, Environment and Sustainability (2025). https://doi.org/10.1016/j.resenv.2025.100263 (opens in a new tab) ScienceDirect (opens in a new tab)

©!-- /wp:paragraph -->

0 Comments